Operational risk is a part of any business that’s innovative and growing. The degree to which risk is acceptable, and how risk is managed determines whether ‘risk’ is helpful or dangerous. If risks are inadequately supervised a big business can be bankrupted suddenly. Since all members of an organization share in operational risk management, everyone needs to have an understanding of risk sources and their management framework.

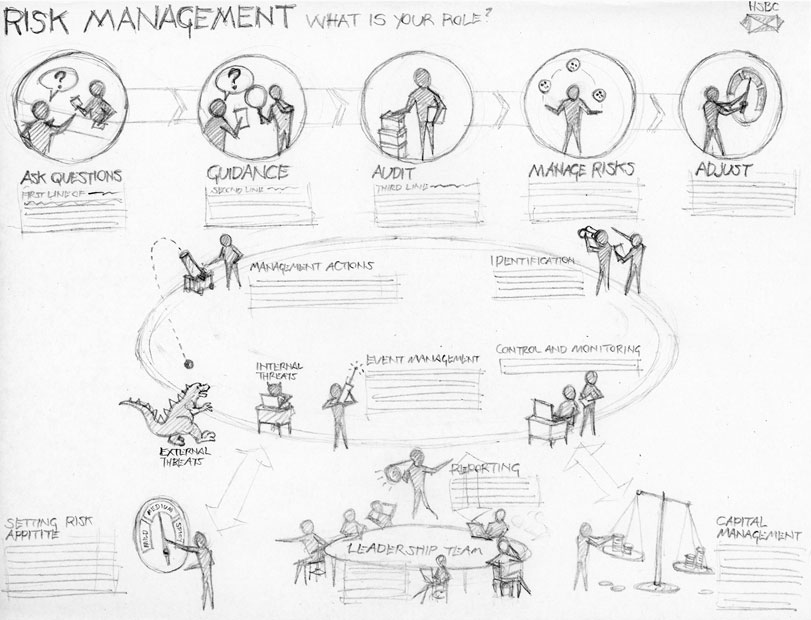

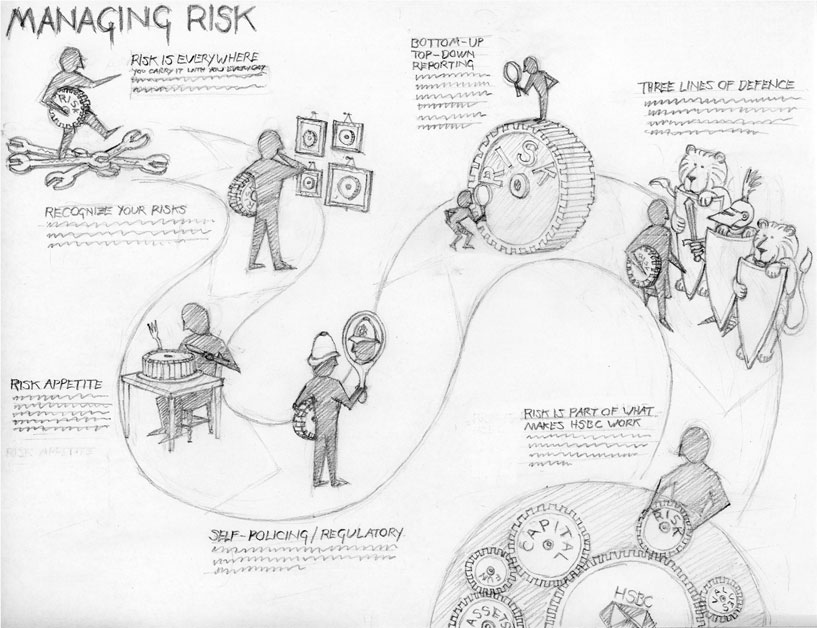

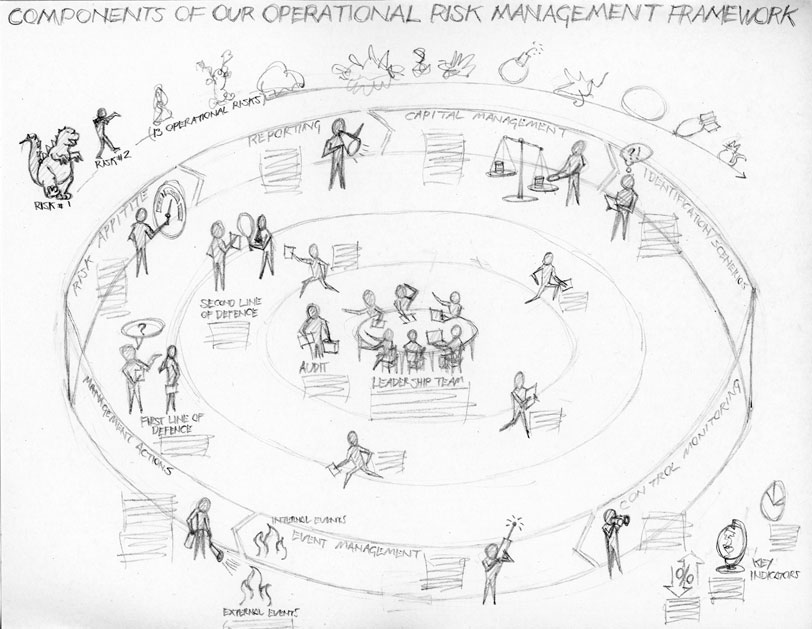

We undertook a very high-level depiction of risk for a global bank. Many of the risk areas are common to all types of businesses. From a visual perspective, we explored several different ways to tackle the conversation. We examined the roles employees each play, the journey that might be taken in negotiating risk, and an alternative view of groups that are frequently involved. Here are three early thumbnails with the tighter view we developed to stimulate thought and conversation about risk management.

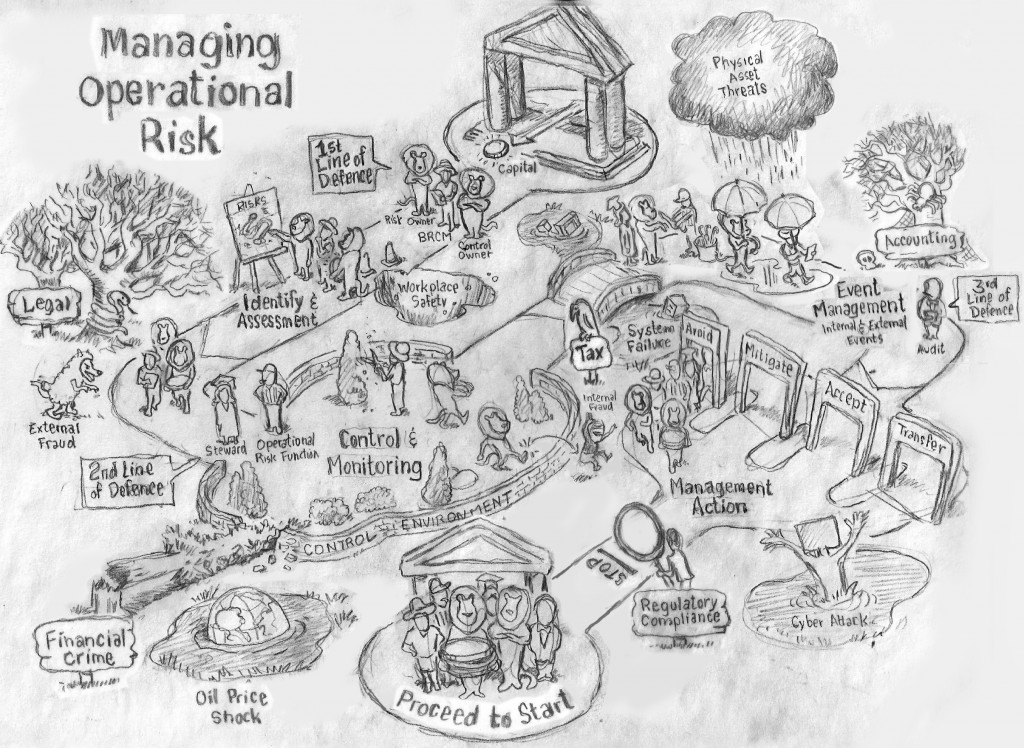

After some continued refinement, we settled on the following view that incorporates a journey through four primary risk management steps; identify and assess, control and monitor, event management, and management action. The characters involved are the primary actors in risk management. All members of the bank will gain a general understanding of risk from this overview as a preface to their specific role responsibilities.